How to invest in dividend paying stocks – Passive income experiment number 2.

As always, this experiment is for entertainment and education purposes only and should not be construed as financial advice in any way – do your own research and make your own choices!

If you’ve been reading about FIRE at all you probably know that passive investing in index funds is the safest vehicle most of us have to reach FIRE. An index fund tracks the whole of a market – whether that’s the FTSE100, the S&P500, emerging markets or any other market. You’ll never beat the markets – but you’ll also closely match the exact performance of a market.

Index funds give the safest and most secure way to invest over the long term – and most of my investments in the future are going to be in these types of funds. Read the full guide to index trackers for fire here.

However, there’s a different area I want to explore – for the sake of experiments.

Some stocks provide lucrative dividends to entice investors. These can range from 1%-10& plus of the share price. This means you can buy stocks that will provide you an income and provide you with steady stock growth over time – hypothetically at least.

Dividend income is often a large part of traditional retirement plans and can provide a nice steady income – providing dividends don’t get cut massive…..like they did in 2020!

For this experiment we’re using Freetrade share dealing app as it’s completely free to buy, hold and cash out your stocks – which means our yearly management fees are an amazing £0. We can both get a free share if you sign up for the app using this link.

Important caveat 1:

The predicted dividend yield for 2021 on the FTSE100 is 3.8%.

The predicted dividend yield for 2021 of the S&P500 is 1.55%

So, if you stick to the index trackers you’ll still make a good dividend income.

But this is a passive income experiment so let’s aim higher.

Making Income From Dividend Paying Stocks – The Experiment

For the purposes of this experiment we’re going to aim for a 6% dividend income from 10 stocks.

I’m going to invest using the FreeTrade app as the trades are free and this will keep our costs down massively low – no management fees thank you. Check out the app here and we’ll both get a free stock. This means we’ll be keeping 100% of our dividends.

Technically we could aim even higher at 8% across 5-10 stocks but this puts us in a somewhat higher risk profile.

How Much are we going to invest?

Now here’s where it gets a little interesting – In the UK we are allowed to get our first £1000 of income from investments tax free so if we can earn this much from the portfolio we won’t pay taxes on it (though if you haven’t maxed your ISA limits all investments should be made there first generally speaking!).

Lower rate tax payers are allowed £1000 of investment income.

Higher rate tax payers are allowed £500 of investment income.

Those earning above £100,000 get no allowance for free investment income – the poor devils.

With a target rate of 6% we’d need to invest around 17,000 to hit our target.

As a higher rate tax payer I’ll be investing 8500 to try and meet this goal – or 850/stock.

I’ve simplified this a little as we have to pay 0.5% fees on all stock buying transactions – so our actual costs are slightly higher.

EXPERIMENT GOAL: Earn the maximum tax-free allowance from stocks outside of an ISA wrapper.

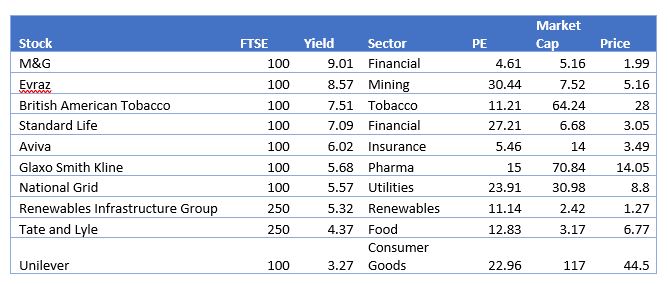

Method: Invest 850 in each of 10 dividend paying stocks across the FTSE250 to total a dividend yield of at least 6%

Key Consideration: Protect the baseline of the shares so we grow rather than lose capital. Use surplus dividend capital to maintain income if necessary but try to avoid this if possible to preserve the income.

Important Caveat 2: A wealth of data shows that individual stock pickers tend to lose money over the long run. I’ve tried to minimise risk by sticking to well established companies within the FTSE250 and have balanced higher risk shares with high dividends against stable shares.

Shut up and tell us what you picked……yeah yeah ok

So, let’s look at the method to the madness with a very very top level look at why I’ve chosen these shares (as always do your own research as I can’t summarise hundreds of pages of company reports and analysis that I’ve tried to read – and as mentioned before most stockpickers lose!).

Starting bottom to top:

Unilever – These guys make products that appear in 99% of all households within the UK including Dove, Persil, Surf, Ben and Jerry’s and Magnum. Their dividend is relatively solid and even pandemics don’t stop them from making sales.

Tate and Lyle – They make food stuffs, additives and other products that appear in tens of thousands of products we eat every day. The company has a forward thinking look at acquisitions and expansion.

Renewables Infrastructure Group – Invest in and own solar farms and wind farms across the world. Renewables as a sector is only likely to grow in the next decade and it’s nice thinking you’ll make the world more sustainable.

National Grid – They own a lot of the infrastructure for the national grid including electricity pylons and gas pipes. An incredibly unexciting but relatively stable option for dividend investing.

Glaxo Smith Kline – Medicine’s, vaccines and healthcare products and the 6th largest pharma company in the world.

Aviva – The UK’s largest insurance company. Though its international efforts have been a bit hit and miss the new CEO is refocusing the company on core markets. A riskier pick possibly.

Standard Life – One of the UK largest pension and ISA providers. I consider this a more high risk investment just given the pressures the sector is facing from us low cost tracker dividend investors. It’s going to be interesting to see how this market performs in the coming years but for now this dividend seems ok.

British American Tobacco – Originally this was Vodafone, but digging into that company wasn’t so great. I have mixed feelings about tobacco companies from their historic ethical performance, but BAT is trying to make massive inroads into vaping over the next 10 years which is promising. I’m not sure whether tobacco profits are even vaguely sustainable in the future but expect they will be for the next 5-10 years. However, the real risk here is the underlying price, it’s not likely to push much higher given professional investment companies now steering away from these types of firms and a declining market.

Evraz – International mining company. Has had a fairly rough 2020 but once the world economy picks up this should have some upside. I hope anyway.

M&G – This divested from prudential and is a financial services/investment provider. It’s had a ridiculously rough year but underlying capital generation is good and they have some quite exciting new investment product in the offing. Definitely high risk.

Total Dividend Yield 6.24%

I’ve tried to balance the higher risk stocks with some safe utilities, consumer goods and healthcare. Overall, still a high-risk strategy compares to an index fund but if we can preserve or grow the capital and deliver a return above 6% we’re probably doing ok.

To choose these stocks I of course focused on dividend yields but I also read as many articles on the companies as possible, read stock analysis, read their company forecasts and financial reports from the last few years and details of any mergers, acquisitions and sales. Sadly, I wouldn’t even call this in-depth analysis but it’s the best I currently had time for!

So in part 2 we’ll wait for a year and find out how well our dividend yields ended up returning and how well the stocks perform. Hopefully we should receive just over £500 in dividend income.

So Should you invest in dividend stocks to reach FIRE?

Hell yes you should – but probably in index trackers.

Some people use dividend paying stocks as a bedrock of their strategy to deliver enough sustained income to FIRE – making this, more than stock growth their top priority. A large portion of retirement portfolios focus on dividends to deliver income.

If you can match the performance of the market, without trying to beat it, then this could be a good long term strategy.

We’re effectively trying to create a passive income here.

But the FTSE100 has return on average 7.39% so we’re still relying on underlying stock growth to actually meet our target returns – otherwise we’d probably have been better off just investing in the whole market.

In this experiment we’ve also solely invested in the UK markets – creating a high risk of being over-exposed in one location. Ideally, we’d want to diversify dividend income across a broad range of countries.

Feel free to rip my dividend portfolio apart in the comments below….or let me know about your own dividend paying successes.