On the surface FIRE can seem really simple – save 25 times your annual expenses and live a life of luxury.

Save 60% of your income and you can retire in just over 10 years.

But the reality is that for a lot of us that is really hard.

Today I wanted to look at this from a philosophical rather than purely mathematical perspective.

In the UK the median wage is now £30,420.

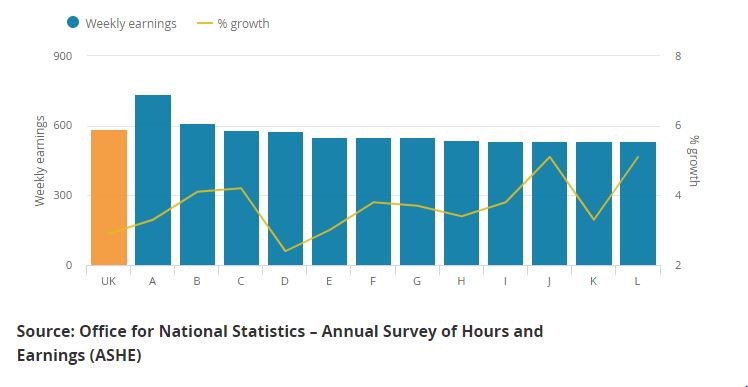

When we look at the whole of the UK we can see that this data is massively skewed by London and other areas.

The average median wage in London is £736 per week. The average for the whole of the UK is £585.

So an average earner trying to reach FIRE on £30420/year or £2027/month after tax would need to save 60% of their income to reach fire in just over 10 years.

That means saving £1216/month. (And 20p technically).

You then have a massive £811 to live on a month.

We’re going to make some assumptions that we are ultra-frugal now and deduct some expenses.

Food: £100/month

Transport: £20/month with no car

Council Tax: £75/month if you’re lucky

Mortgage or rent: £200/month – I’m assuming your house hacking in some way! (Guide to lowering your housing costs here)

Water: £30/month

Mobile Phone: £10/month

Internet: £20/month

Electric/Gas: £40/month

We are already down to £306/month for anything not covered above. And we’re already assuming you’re at rock bottom for all your expenses. If your rent or mortgage is an extra £100 or £200 or more life gets a bit harder – and the average UK mortgage payment was £671 in 2016-2017 (Source Gov Data)

And we haven’t included any possible fun at all. We haven’t included Christmas, your yearly vacation or anything else. Live in a rural area and have a car – let’s take another £100 a month for fuel, insurance and repairs – and this is for a seriously old banger like mine.

As you can see things are starting to look pretty dire in the UK if you want to FIRE in a short time frame.

If we double the timeframes and look at a 20 year FIREline (My new favourite term) we only need to save around 45% of our income.

But this only gives us £1115 (ok fine £1114.85) to spend/month.

On our ultra-frugal budget we’d have £620 left over to spend on frivolities like a realistic mortgage, a car that doesn’t fall apart after 10 miles or shake when you hit 60 on the motorway. We might even afford some additional luxuries like a meal out every now and again and two holidays a year. I might even buy some nice Christmas presents.

What I’m getting at in a long roundabout way is this

If you’re going to scrimp and save your way to FIRE you’re going to have a pretty miserable time along the way.

I’m all in favour of a tight budget, I’m pretty keen on saving and investing as much as possible but at some point you’ll start to burn out. This is why I stopped tracking every expense, stopped worrying as much about my savings rate and started working on the big picture – earning more income to save more income whilst still enjoying my life as much as possible.

I think it’s important for the UK fire community to realise these key differences in our markets compared to a lot of the US FIRE literature we read – wages are numerically lower (In the US the Median income is $48672), house prices are more expensive ($200,000 median in the US compared to £231,855 in the UK) and our overall purchasing power is lower (65.4 compared to 100 for the USA – which is statistically used as the baseline for comparative cost of living and purchasing power data). Obviously, there are exceptions but our house prices versus our incomes can make our lives a lot harder.

At some point in your FIRE journey in the UK you are very likely to realise that really what you need is to earn more money. You may need a new job, a side hustle or to move to a cheaper area to live. The problem really is that scrimping and saving can get you there but the costs can be very high mentally.

Would love to get your comments on this and see if you agree I’m sure lots of you are doing great with the saving and doing much better than me at hitting those 70%+ figures. If you think I’ve missed a trick let me know!