What makes the best investment strategy? High returns on investment, stability, safety? Do you want a simple investing strategy that means you never have to look at the stock market, never have to look at individual stocks, never have to sift through company returns and statements to find the next hot stock pick and never have to see your stock portfolio fall more than the rest of the market.

Introducing the index tracker.

The index fund is the golden standard of the financial independence investing.

In fact, it’s so good that Warren Buffet has the following to say “In Berkshire’s 2005 annual report, I argued that active investment management by professionals – in aggregate – would over a period of years underperform the returns achieved by rank amateurs who simply sat still. I explained that the massive fees levied by a variety of “helpers” would leave their clients – again in aggregate – worse off than if the amateurs simply invested in an unmanaged low-cost index fund.”(Bekshire Hathaway Shareholder Letter http://www.berkshirehathaway.com/letters/2016ltr.pdf)

We want a low cost index tracker that is not managed by investment firms looking to put large fees in their pockets.

So how do Index Tracker Funds Work?

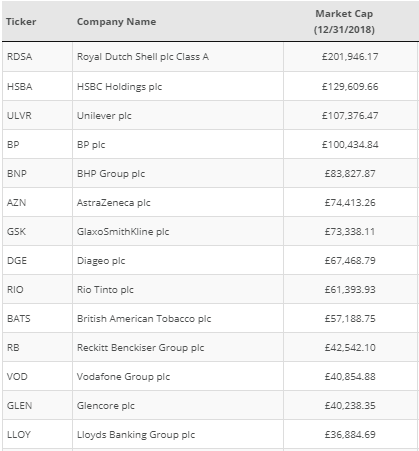

Index tracker funds literally spread your money across the entire index they track. So let’s take the FTSE100 – the hundred largest companies in the UK.

A normal investor might divide £1000 between HSBC stocks, part of their money into Royal Dutch Shell and part of their money into Vodafone.

An index fund investor would divide their £1000 between all of the companies in the FTSE100 in a FTSE100 Index Tracker Fund.

Their investment in the tracker would be divided into equal shares amongst all of the top 100 companies (equal in terms of their share of the market rather than numerically equal!).

Hopefully you can instantly see how the second investors strategy is much less risky. Their return should exactly match the market as their investment is spread equally to match that market.

The first investment strategy is much riskier as if 1 of the 3 companies has a really bad year you could lose a lot of money. Of course, If your magic 3 stocks perform above the rest of the market you could make more but the problem with this is that if most professional investors can’t beat the market consistently…can you? (PS the answer is yes if you are Warren Buffet…..but if you are you probably don’t need this guide).

How do I start Investing in one?

I personally use Vanguard for the majority of my ISA index tracking, I also use AJBell for my SIPP (until Vanguard opens theirs I expect)(Update Vanguard now does SIPP’s) and I also have funds in another account. Vanguard is my personal favourite (And please remember I am in no way giving you financial advice).

Vanguards fees are amongst the lowest on the market at 0.15% as an account fee and around 0.22% for individual funds.

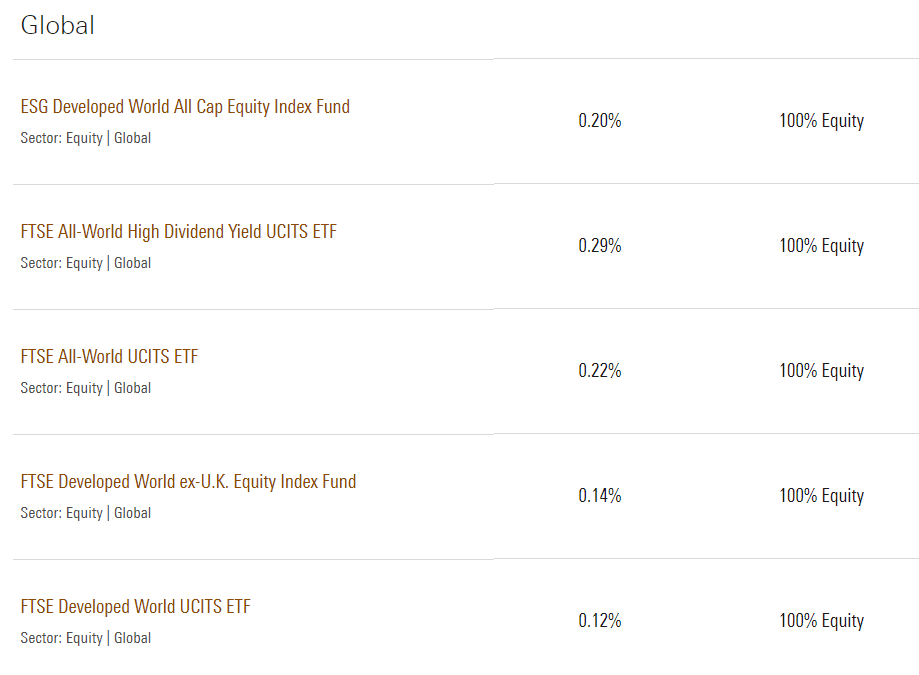

They offer a wide range of index trackers and they have their life strategy funds which automatically divide your investments amongst a range of Index Trackers.

Which Tracker Funds?

This is where it can get a bit tricky – when you first open up your dashboard you’ll see a lot of different fund options – there’s the FTSE100, the FTSE250, the S&P500, global equities, global equities excluding the UK, emerging markets – the list is endless.

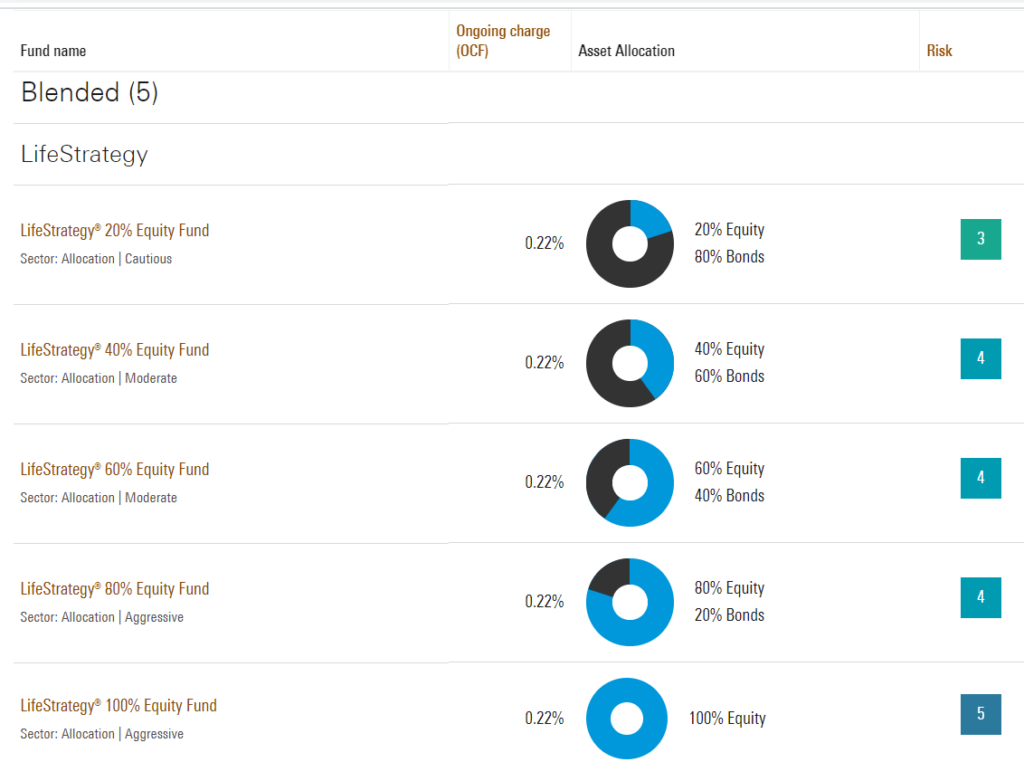

Life Strategy Funds

I’m all about simplicity so I love the lifestrategy funds – these are pools of index funds set up for where you are on your investing journey. The fees are slightly higher but these are done for you diversified investment portfolios. The weighting of equities tallies to the rate of risk. Typically, younger long term investors can have a higher weighting in equities as they have longer time frames. Investors tend to want more stable income in later life and bonds provide this.

I’m young(ish) and have a relatively long time horizon for investing so 100% equities works well for me – though make your own decisions here.

Build your own portfolio

If you want to shave a few fractions of a percent off your investing fees then there is no harm in building your own portfolio. Typically, you will use the FTSE100 and the S&500 as your benchmark funds and then diversify across world funds and emerging markets. You will then need to rebalance your portfolio each year to make sure the ratio (weighting of each fund) is the same to create a balance portfolio. I’m going to go into more details on building your own portfolio in a future post as for now I want to keep index investing simple and practical for most investors.

How should I invest?

This really depends on your goals – I used to drip feed a large percentage of my income into index trackers every month. I’ve now moved onto real estate and other business ventures so have temporarily halted my regular investing.

Regular investing makes the whole system hassle free as you don’t have to think about it. There’s also no temptation to spend your money earmarked for investments as it comes straight out of your paycheck.

There’s also the question of choosing between ISA’s, SIPP’s(Self Invested Pension) and taxable investing accounts. This is explored more in other posts as it’s a very complex topic. For most people an ISA is best if you want to be able to access your funds at will. If you are saving purely for retirement then the tax advantages of a SIPP are unbeatable.

Pros of Tracker Funds

Super simple – which makes it easier for you to focus on other aspects of your FIRE journey such as side hustles, savings rates and income.

Low cost – significantly lower cost than actively managed funds, which can add up to hundreds of thousands of pounds extra in your retirement fund.

Highly diversified – acts like a spread bet across hundreds or thousands of stock drastically decreasing your risks.

Cons of Tracker Funds

Benchmarking – You’ll never beat the market. Not that this is really a problem for us we like slow steady gains.

Market Volatility – In any period the markets can crash and you can see tens of thousands wiped off the value of your investments. This is only a problem if you have to take money out as the markets always recover and continue to grow – it just takes time and patience.

Other Risks

There is one other risk I want to address and this is opportunity cost. This is more for advanced FIRER’s who are looking for faster returns to reach financial independence sooner. Tying your money up in the stock market is a long term strategy, if a great business or investment opportunity comes up while you have that money invested you might not be able to get your capital – or will take a loss to do so if we are in a volatile period. For most investors you shouldn’t worry about opportunity costs too much but I thought it was worth mentioning.

Overall

There’s a reason pretty much every FIRE addict invests in index trackers, they are the safest form of investing for the average investor and can be as simple or as complex as you like in terms of how you invest.